Half Yearly Return: PAS-6 by all Unlisted Public Companies

What is PAS-6 Filing ?

PAS-6 refers to a form that is required to be filed by an unlisted public company with the Registrar of Companies (RoC) in India. The full form of PAS-6 is "Reconciliation of Share Capital Audit Report." This form is required to be filed under Rule 9A of the Companies (Prospectus and Allotment of Securities) Rules, 2014, which was introduced by the Ministry of Corporate Affairs (MCA) in September 2018.

Form PAS-6 is a statement that reconciles the total issued capital of an unlisted public company as per its records with the depository's records, in case the company has issued any securities in dematerialized form.

The Ministry of Corporate Affairs (MCA) introduced Rule 9A to the Companies (Prospectus and Allotment of Securities) Rules, 2014, through the Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2018, vide notification dated 10th September 2018. The rule was introduced to enable unlisted public companies to issue securities in dematerialized form, effective from 2nd October 2018.

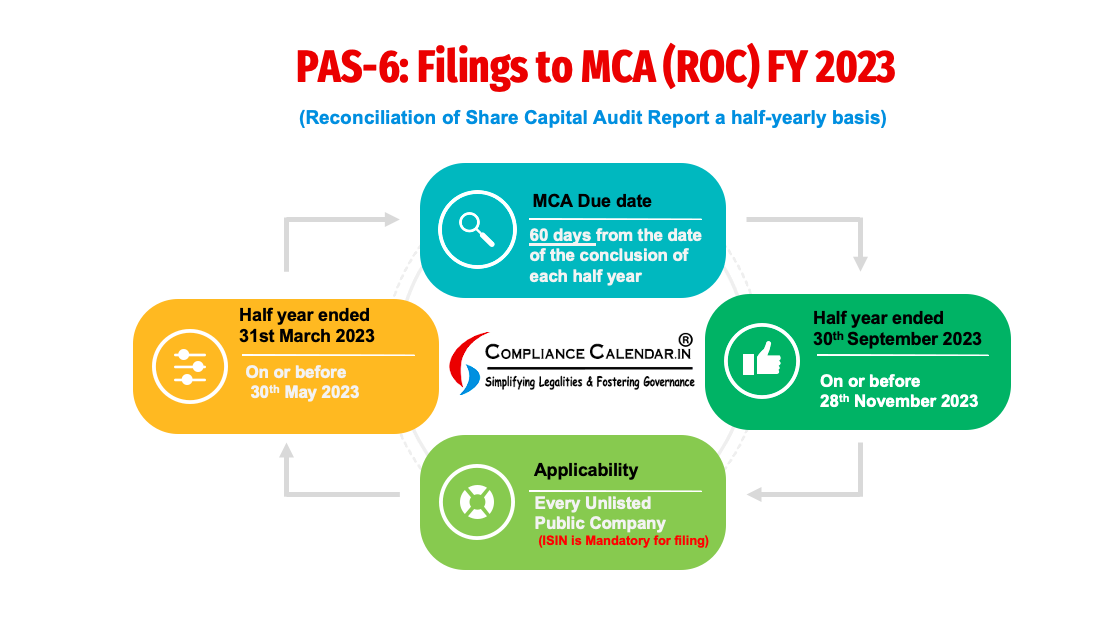

The amendments also introduced the requirement for a Reconciliation of Share Capital Audit Report to be filed on a half-yearly basis in e-Form PAS-6.

When is it introduced, and why?

PAS-6 was introduced to enhance transparency, reduce the risk of fraudulent practices, and streamline the process of issuing and managing securities. By requiring unlisted public companies to issue securities in dematerialized form, the amendments aimed to bring them in line with the practices followed by listed companies. The introduction of the Reconciliation of Share Capital Audit Report was aimed at ensuring that the records of the company's share capital were accurate and up-to-date.

The introduction of e-form PAS-6 by the Ministry of Corporate Affairs (MCA) was in pursuance to sub-rule (8) of Rule 9A, which was amended vide the Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019, with effect from 30th September 2019.

Rule 9A corresponds to Section 29 of the Companies Act, 2013, which provides that any securities held in physical form by any person shall be dematerialized by the person concerned in the manner prescribed by the Securities and Exchange Board of India (SEBI). The introduction of Rule 9A was aimed at bringing unlisted public companies in line with the practices followed by listed companies and to enhance transparency, reduce the risk of fraudulent practices, and streamline the process of issuing and managing securities.

Through This sub-rule mandated that every unlisted public company shall issue securities only in dematerialized form and that they shall ensure that the securities are held in a dematerialized form with a depository. The sub-rule also required every unlisted public company to provide for the reconciliation of share capital audit on a half-yearly basis by a practicing company secretary or a practicing chartered accountant.

To comply with this requirement, the MCA introduced e-form PAS-6, which is a form for the reconciliation of share capital audit report. The form is to be filed by every unlisted public company on a half-yearly basis, i.e., by 30th June and 31st December of every year, starting from the half-year ended on 30th September 2019.

Pre-Certification is mandatory by Company Secretary in practice or Chartered Accountant in practice

Rule 9A(8) of the Companies (Prospectus and Allotment of Securities) Rules, 2014, mandates that every unlisted public company shall submit Form PAS-6, which is a reconciliation of share capital audit report, duly certified by a Company Secretary in practice or Chartered Accountant in practice to the Registrar of Companies (RoC) within 60 days from the conclusion of each half-year.

The purpose of filing this form is to reconcile the differences between the total number of shares held in the company's records and the total number of shares held in dematerialized form with the depositories. The certification by a Company Secretary in practice or Chartered Accountant in practice ensures the accuracy and authenticity of the information provided in the form.

ISIN is mandatory for filing PAS-6

ISIN (International Securities Identification Number) is a unique identifier assigned to each security and is mandatory for filing Form PAS-6, which is a reconciliation of share capital audit report. The introduction of ISIN in Form PAS-6 was mandated by the Ministry of Corporate Affairs (MCA) to ensure accurate identification of securities held by the company in dematerialized form with the depositories.

As per Rule 9A(8) of the Companies (Prospectus and Allotment of Securities) Rules, 2014, every unlisted public company is required to file Form PAS-6, which includes details of the securities held by the company in dematerialized form with the depositories. The form requires the company to provide the ISIN of each type of security held in dematerialized form, along with other details such as the number of securities issued, the number of securities held in dematerialized form, and the number of securities held in physical form.

Filing Form PAS-6 with accurate details of ISIN is crucial for maintaining transparency and ensuring compliance with the provisions of the Companies Act, 2013, and the Companies (Prospectus and Allotment of Securities) Rules, 2014..

Non-Applicability-

Rule 9A does not apply to certain categories of unlisted public companies. These include:

(a) Nidhi companies, which are companies formed for the purpose of cultivating the habit of thrift and savings among its members, and accepting deposits from and lending to its members only.

(b) Government companies, which are companies in which not less than 51% of the paid-up share capital is held by the Central Government or any State Government(s) or partly by the Central Government and partly by one or more State Governments.

(c) Wholly owned subsidiaries, which are companies where the entire share capital is held by another company (holding company).

Hence, Nidhi companies, government companies, and wholly owned subsidiaries are exempt from complying with the provisions of Rule 9A and are not required to issue securities in dematerialized form or file Form PAS-6.

Filing of PAS-6 by Private Company-

Private limited companies are not required to file Form PAS-6, compliance form that needs to be filed by every unlisted public company. The form provides details of all the shares held in dematerialized form by the shareholders of the company.

It is important to note that the requirement of filing Form PAS-6 is only applicable to unlisted public companies and not to private limited companies. But, in case if private limited company has taken demat connectivity, it may be required to file Form PAS-6 if it subsequently becomes an unlisted public company by way of an initial public offering (IPO) or any other means.

Penalty for Non-Filing

As there is no penalty prescribed under Rule 9A of the Companies (Prospectus and Allotment of Securities) Rules, 2014 for non-compliance, Section 450 of the Companies Act, 2013 will be applicable in that case.

As per Section 450, if any provision of the Companies Act, 2013, or the rules made thereunder, does not provide for any specific penalty or punishment for non-compliance, then the company and every officer of the company who is in default, or any other person shall be punishable with a fine which may extend up to Rs. 10,000. Additionally, in case the contravention continues, a further fine of up to Rs. 1,000 per day can be levied for every day after the first during which the contravention continues.

Conclusion-

National Company Law Appellate Tribunal (NCLAT) passed an order on August 24, 2020 in the matter of Swayambhu Leasing and Finance Limited & Himson Knitting Industries Private Limited, where it was held that the filing of Form PAS-6 is mandatory for every unlisted public company that has issued securities in dematerialized form. The case was related to a private limited company that had subsequently become an unlisted public company by way of a scheme of arrangement. The company had failed to file Form PAS-6 after the allotment of shares in dematerialized form. The NCLAT held that the company was required to comply with the provisions of Form PAS-6 and directed the company to file the form within a specified period.

These cases highlight the importance of complying with the requirements of Form PAS-6 and the consequences of non-compliance. Compliance Calendar suggests that all companies must ensure timely and accurate filing of the form to avoid any penalties or legal consequences.

Company Secretary |AIR-17 CS Foundation| Commerce graduate l LLB from Dr. Bhimrao Ambedkar Law University

1yMa'am as of now it is mandatory for every public company to have shares in demat form. Is it necessary for a public company to file PAS-6 if it has made default in dematerialising it's shares and all of them are still physical?